Supermodel: The rise of the complexity curve

Supermodel II: The rise of the complexity curve

A pivot toward European markets, wealth management, and active ETFs is redrawing the asset management map. Yet ambition alone won’t sustain momentum.

Explore insights from 200 global leaders on the emerging operating models driving scale, agility, and regulatory efficiency — amid mounting operational demand and the need for speed to market. Their responses trace a clear curve of complexity.

Where do you stand on the curve?

Europe’s momentum is unmistakable

41% of fund managers prioritising European distribution over the next two years VS 34% of fund managers when asked the previous year.

2. The speed wars and the operational red zone

With firms racing to launch funds faster, operations are hitting their limits. Confidence in readiness is low, and the stakes are high. See what it takes to stay out of the red zone.

3. Hype or happening? The AI reality check

AI is transforming how firms manage risk, market, and respond. But not yet how they operate. Fewer than one in five firms have deployed it across operations. Momentum is building, but will adoption overcome the structural barriers?

4. The great green divide. Why firms look to Europe for sustainability

Only 37% of managers now prioritise sustainable funds—down from 48%. The pullback is sharpest in the US, while Europe holds firm. But what does the shift in ESG strategy mean for European funds?

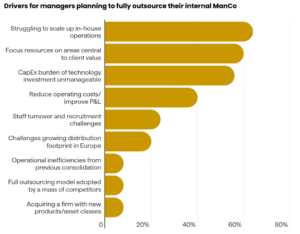

5. The rise of the ‘Super ManCo’

Outsourcing is no longer a cost move; it’s a capability play. With more firms shifting governance and valuation to third-party ManCos, the Super ManCo has emerged as the new model for operational scale and control. See how it’s changing what it means to be ready.

6. Staying ahead of the complexity curve. The era of the Supermodel

As growth, regulation, and innovation accelerate, the gap between ambition and readiness is widening, creating a curve of readiness which we’ve dubbed the Complexity Curve. See what it takes to stay ahead.

The Supermodel: How firms can say yes to complexity

To capture the growing opportunity and confront the unprecedented complexity that comes with it, firms need a new kind of operating model. One built on partnership, scale, and adaptability. We call it the Supermodel.

This partnership-driven model is emerging as the new foundation for competing at scale in an opportunity-rich, increasingly complex world.

Are you ready for the next era of complexity?

What global leaders are saying

“In those marketplaces where only the gold and silver medal count, you need to have a process that makes sure you’re in the gold and silver medal positions.”

– Operations Executive, Global Private Markets Manager

“I think the combination of discounted valuation multiples and diversification to reduce reliance on the US, where policy has become unpredictable, are probably what’s driving the shift in allocations towards Europe.”

– Managing Director, Global Alternative Manager

“We took a view outsource everything unless there’s a really good reason why we shouldn’t. And once you’ve made that decision, and it’s quite an emotional one, but once the company is on that same footing across the piece, it’s much easier to have those tough conversations with people.”

– Operations Executive, European Public and Private Markets Manager